West Texas Intermediate (WTI) oil prices extended their decline Wednesday after Israel's ceasefire agreement with Hezbollah reduced geopolitical risk.

However, losses were limited by an unexpected, substantial draw in US oil inventories, suggesting tighter supply conditions.

This was supported by a report indicating that OPEC+ may delay plans to increase production with the cartel meeting on December 1.

The American Petroleum Institute data revealed a nearly 6-million-barrel decline in US oil inventories for November 22, defying analyst expectations for a 0.25-million-barrel build.

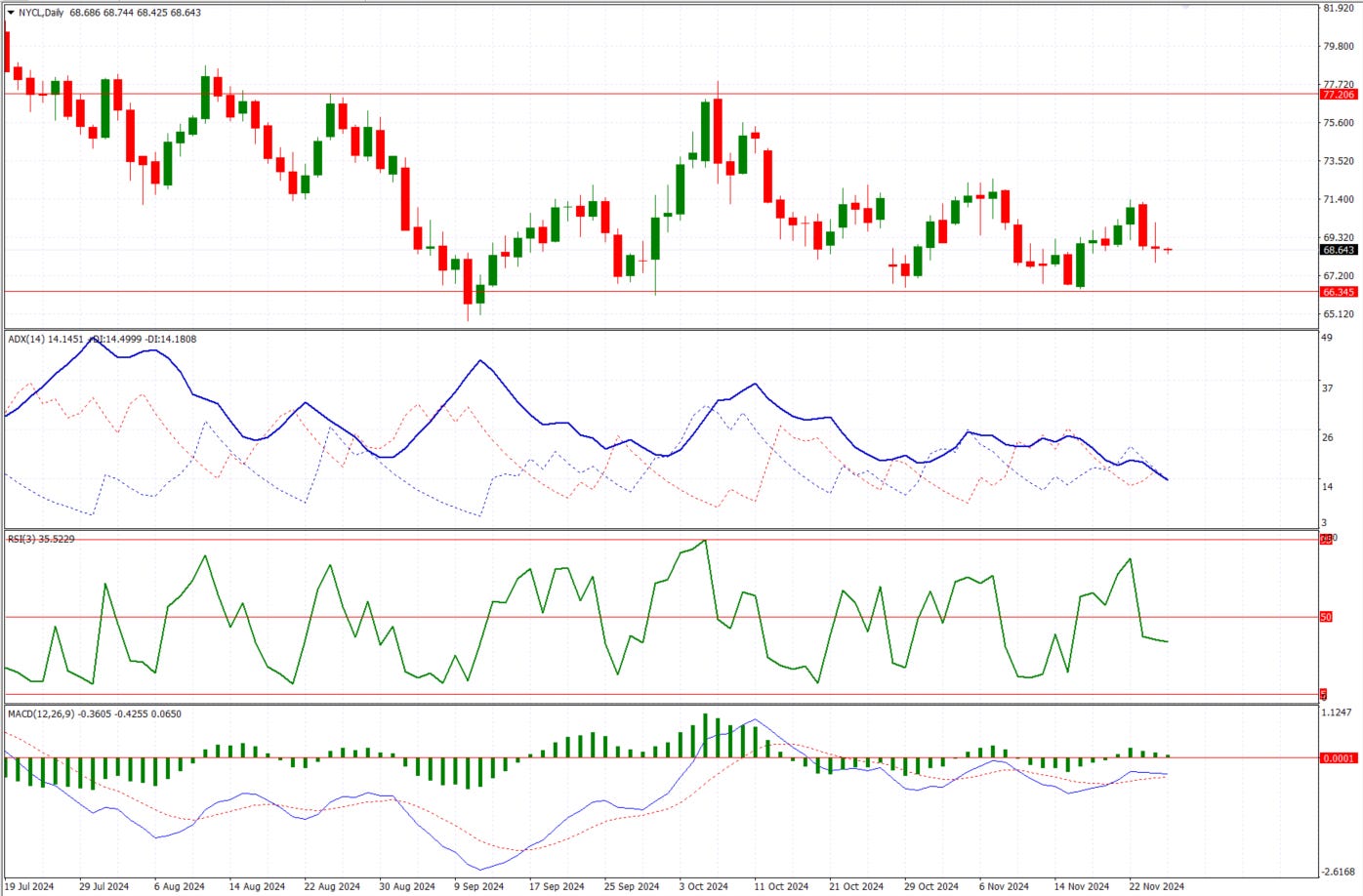

Based on the technicals, the 3-day Relative Strength Index (RSI) is mixed, while the Moving Average Convergence Divergence (MACD) remains mixed.

The Average Directional Index (ADX) suggests a ranging market.

Overall, since the recent bounce from near-term support at $66.60–80, the upside target is expected to hold toward $72.20–25.

Reassessing positions at this level is recommended in case of profit-taking.

Daily Chart West Texas Intermediate (WTI)

This content is provided by Australian Financial Services Corporation (AFSC) Pty Ltd (AFSC), trading as Crystal Ball Finance. AFSC is a corporate authorised representative (CAR No. 001275455) of ShareX Pty Ltd (AFSL No. 519872).

For information relating to our financial services, you should refer to our Financial Services Guide.

Crystal Ball Finance content is designed as the opinion only and is general in nature. It does not take account of your objectives, financial situation or needs. Nothing in this content shall be construed as a solicitation to buy or sell any security or product or to engage in or refrain from engaging in any transaction. There are risks involved in any financial investment and trading strategy, and the value of any investment can and does fluctuate and may even become valueless. You should consider the appropriateness of any investment or trading strategy having regard to your circumstances. We recommend that you obtain financial, legal and taxation advice before making any financial investment decision or applying any trading strategy. This content is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty that it is accurate, complete or up to date. We accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. Crystal Ball Finance does not accept any liability whatsoever for any direct, indirect, consequential or other loss arising from any use or application of its content.