Wall Street’s Crystal Ball is Murky

Wall Street’s “crystal ball” was distinctly cloudy on Thursday after another disappointing quarterly result from several big tech companies, while economic data release showed the U.S. economic growth rebounded in the third quarter.

As the finishing bell rang on the New York Stock Exchange (NYSE), the blue-chip Dow Jones Industrial Average rose +194.17 points, or +0.6%, to 32,033.28 after Caterpillar shares jumped +9.2%, boosting the blue-chip after reporting a better-than-expected quarterly profit.

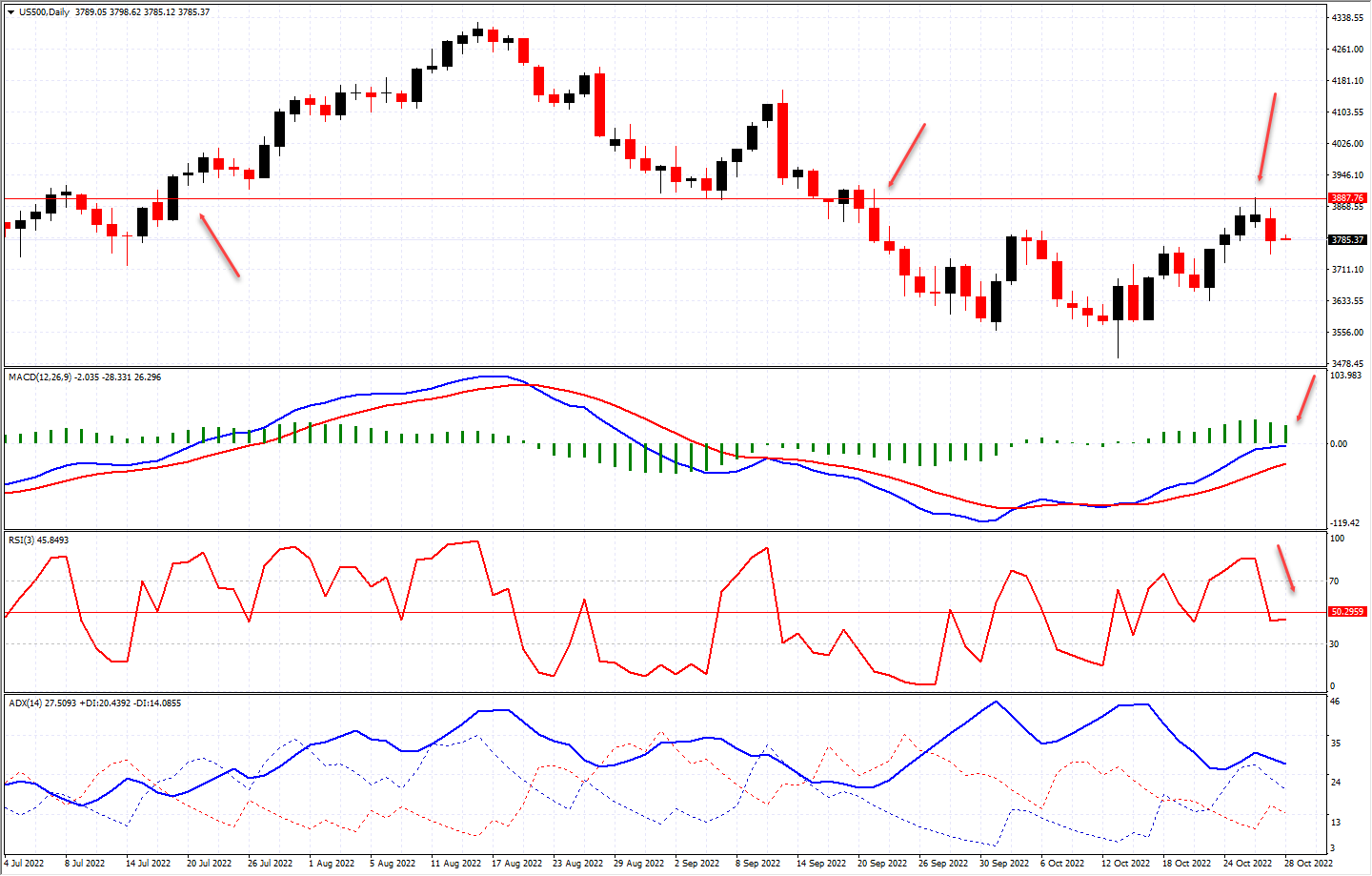

The broad-based Standard & Poor’s 500 Index slipped –23.30 points, or -0.6%, to 3,807.30, while the rich-tech Nasdaq Composite Index declined -178.32 points, or -1.6%, to 10,792.67.

Daily Chart of the Standard & Poor’s 500 Index

Meta Platforms plunged -24.6% after the Facebook parent followed the trend set by Microsoft Corp and Alphabet Inc by providing gloomy forward guidance. Alphabet fell- 2.9%, and Microsoft slid -2%, respectively.

Shares of Amazon also plunged -13.24% in after-hours trading after the retail giant issued an estimate for sales in the last quarter of the year, which came in well below forecasts.

The stock initially fell -4.1% in regular trading before the release of its latest quarterly results.

In economic data, the number of Americans filing new claims for unemployment benefits fell unexpectedly last week.

The Department of Labour reported 217,000 initial unemployment claims for the week ending Saturday, which was up 3,000 from the prior week, but below the 220,000 economists had predicted.

While in other data, the U.S. gross domestic product in the third quarter comes as a welcome surprise after the third-quarter GDP reading showed the U.S. economy returned to growth in the July-Sept period, along with steady quarterly core inflation helped take the sting out of earnings.

The U.S. GDP rose +2.6% on an annualized basis.

Another pullback in bond markets helped support stocks in companies that weren't reporting quarterly results.

The yield on the 10-year Treasury fell to 3.91% from 4.01% late Wednesday. The two-year yield fell to 4.30% from 4.42%. Yields rise as bond prices fall.

In other markets, Bitcoin (BTC), the world’s largest cryptocurrency by market value, staged a modest course correction and slipped against the US Dollar after booking a -3.16% loss to US$20,300.00 after changing hands in the boundaries of $20,240.00 and $20,900.00.

Ethereum (ETH), the second-largest digital asset by market capitalisation, fell -5.2% to $1,512 (as of writing) after changing hands in the boundaries of $1,502.00 and $1,584.00.

In Commodities, precious metals were firmer, with spot gold down -0.2% to $1,661 and silver sliding by -0.1% to $19.48.

Oil markets were firmer, with global oil benchmark Brent crude rising +1.2% to $94.94 per barrel, while U.S. benchmark West Texas Intermediate was around $89.50, up +1.9%.

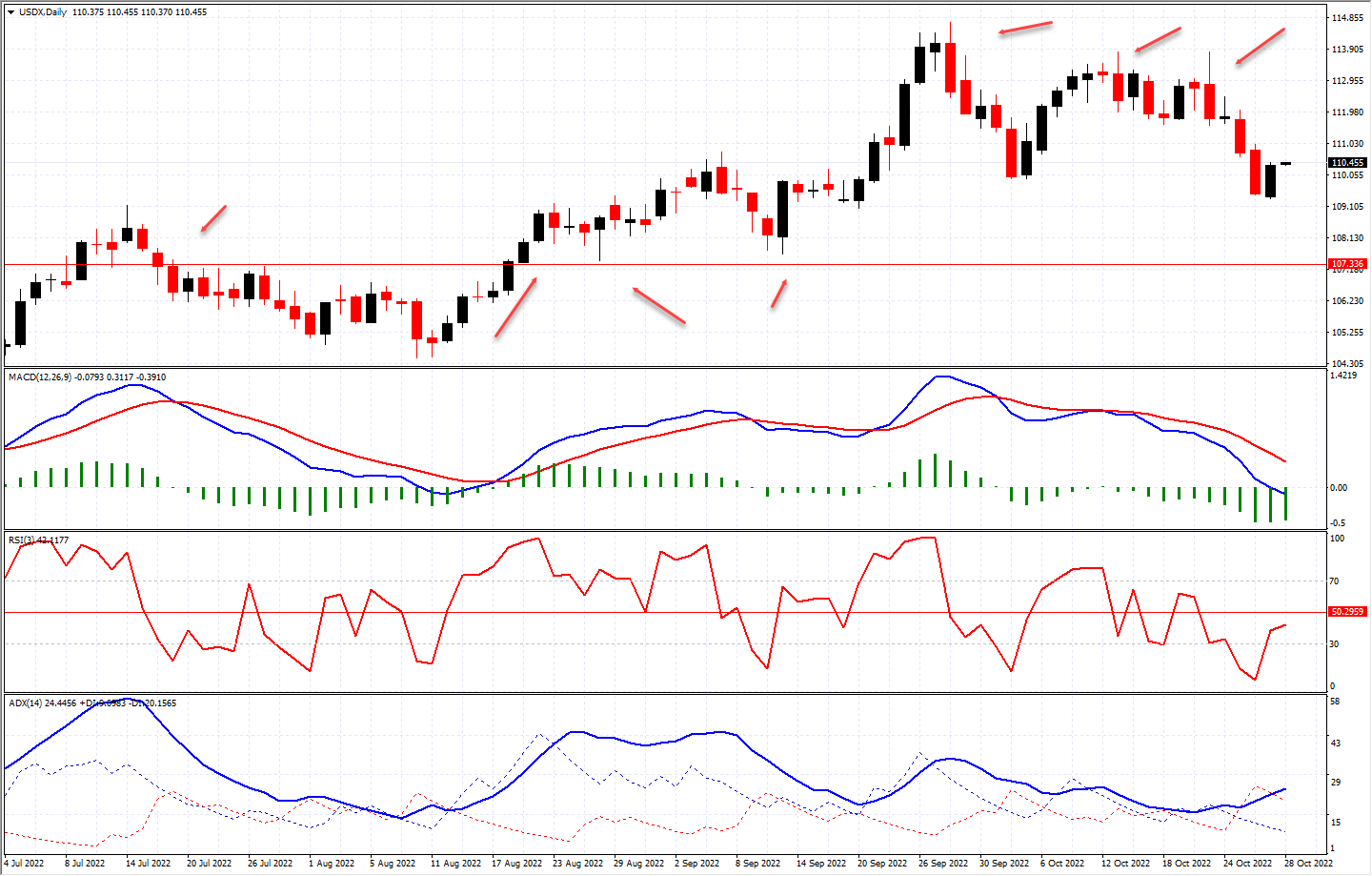

The US dollar index (US DXY), which measures the greenback’s strength against a basket of major peers, bounced +0.9% to 110.40.

The euro slipped to 0.9960 after the European Central Bank (ECB) increased the cost of borrowing to tackle inflation, which soared across the eurozone last month to 9.9%.

Matching financial market expectations, the (ECB) raised its key rates by 75 basis points (bps) following the October policy meeting.

The Australian Dollar also took a tumble to $0.6448, and the Japanese yen is buying ¥146.30 against the greenback.

Chart of the US dollar index (US DXY)

This content is provided by Australian Financial Services Corporation (AFSC) Pty Ltd (AFSC), trading as Crystal Ball Finance. AFSC is a corporate authorised representative (CAR No. 001275455) of ShareX Pty Ltd (AFSL No. 519872).

For information relating to our financial services, you should refer to our Financial Services Guide.

Crystal Ball Finance content is designed as the opinion only and is general in nature. It does not take account of your objectives, financial situation or needs. Nothing in this content shall be construed as a solicitation to buy or sell any security or product or to engage in or refrain from engaging in any transaction. There are risks involved in any financial investment and trading strategy, and the value of any investment can and does fluctuate and may even become valueless. You should consider the appropriateness of any investment or trading strategy having regard to your circumstances. We recommend that you obtain financial, legal and taxation advice before making any financial investment decision or applying any trading strategy. This content is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty that it is accurate, complete or up to date. We accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. Crystal Ball Finance does not accept any liability whatsoever for any direct, indirect, consequential or other loss arising from any use or application of its content.