The West Texas Intermediate oil bears take another swipe at the bullish support

The West Texas Intermediate (WTI) crude oil prices took another downside challenge Wednesday; however, the $76.90-95 support held limited losses as the bulls once again stepped back into the market and defended this region.

In economic data, U.S. crude oil stocks soared last week by 16.3 million barrels to 471.4 million barrels, the highest level since June 2021, the Energy Information Administration (EIA) said.

Helping to support prices was the International Energy Agency's (IEA) prediction that oil demand will rise by 2 million barrels per day (bpd) in 2023, up 100,000 bpd from last month's forecast to a record 101.9 million bpd, with China making up 900,000 bpd of the increase.

The IEA said China would account for almost half of 2023 oil demand growth after relaxing its COVID-19 curbs.

The U.S. Dollar Index, which typically trades inversely with oil, rallied to a 6-week high at 103.55.

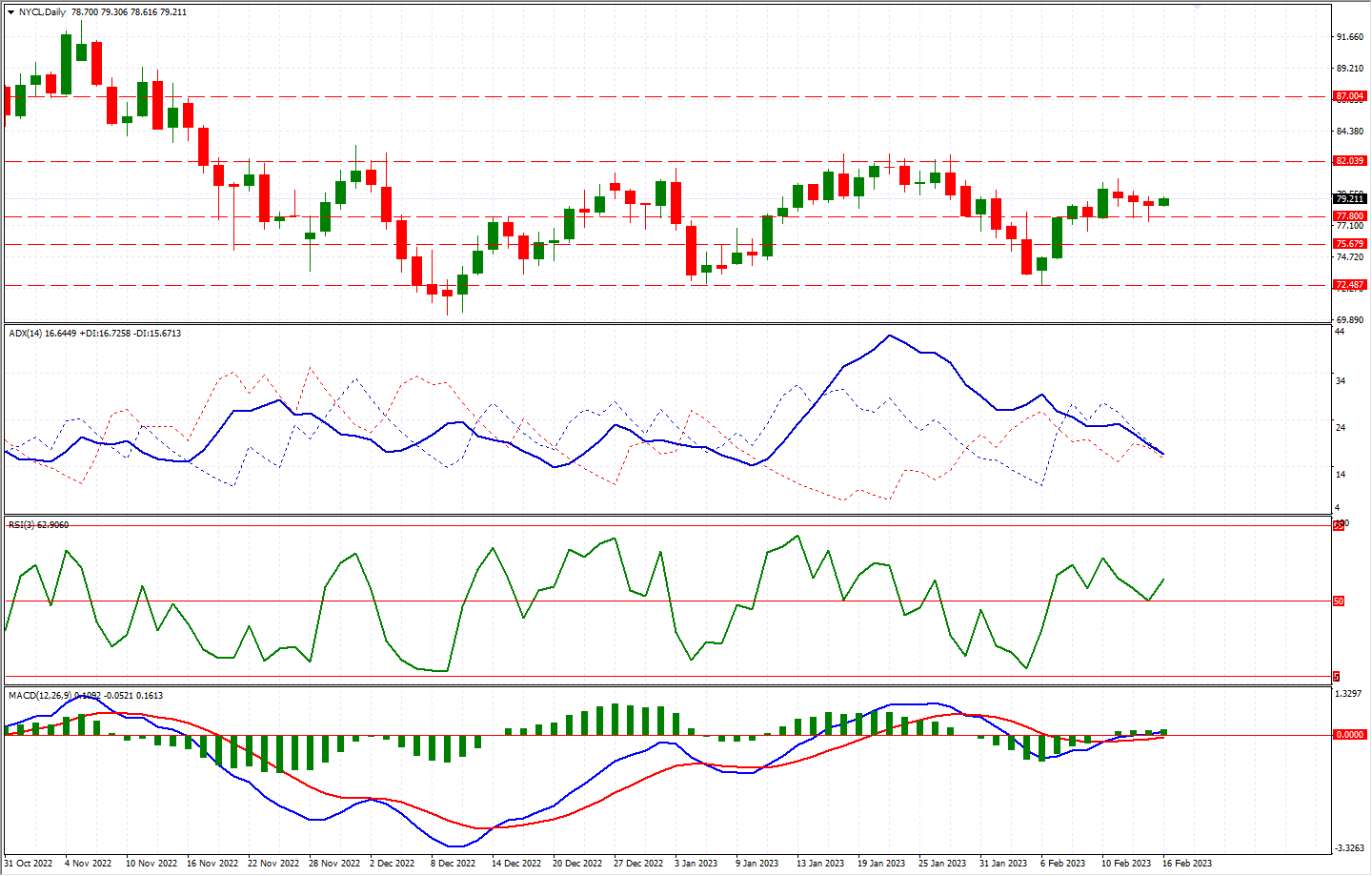

Based on the technical assessment, the Relative Strength Index (RSI) 3-day ‘lookback’ indicator holds a positive bias as it rebounded off the 50-midway point.

The Moving Average Convergence Divergence (MACD) oscillator holds a weak positive bias, and the ADX (trend) indicator supports a ranging market.

The overnight rejection at $76.90-95 still appears vulnerable and, if breached, views the region of $75.60-80, while the near-term cap is at $82.00-45.

Daily Chart West Texas Intermediate (WTI)

This content is provided by Australian Financial Services Corporation (AFSC) Pty Ltd (AFSC), trading as Crystal Ball Finance. AFSC is a corporate authorised representative (CAR No. 001275455) of ShareX Pty Ltd (AFSL No. 519872).

For information relating to our financial services, you should refer to our Financial Services Guide.

Crystal Ball Finance content is designed as the opinion only and is general in nature. It does not take account of your objectives, financial situation or needs. Nothing in this content shall be construed as a solicitation to buy or sell any security or product or to engage in or refrain from engaging in any transaction. There are risks involved in any financial investment and trading strategy, and the value of any investment can and does fluctuate and may even become valueless. You should consider the appropriateness of any investment or trading strategy having regard to your circumstances. We recommend that you obtain financial, legal and taxation advice before making any financial investment decision or applying any trading strategy. This content is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty that it is accurate, complete or up to date. We accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. Crystal Ball Finance does not accept any liability whatsoever for any direct, indirect, consequential or other loss arising from any use or application of its content.